Singapore’s property market is set to change forever with the launch of 11 new housing sites in key districts including Newton, Tanjong Rhu, Dover and Bedok. These sites are the official release of prime plots under the government land sales (GLS) programme, which is the main mechanism through which the government releases land for private residential development. The government land sales process plays a crucial role in shaping housing supply, urban development, and market demand in these districts. The sites announced will attract a lot of attention from developers and investors. Along with these prime plots, the government has also released two executive condominium (EC) parcels to meet the growing demand for homes. With these sites out, the event marks a big shift in Singapore’s housing market in 2025 and beyond for homebuyers, investors and developers.

Key Sites and Strategic Locations

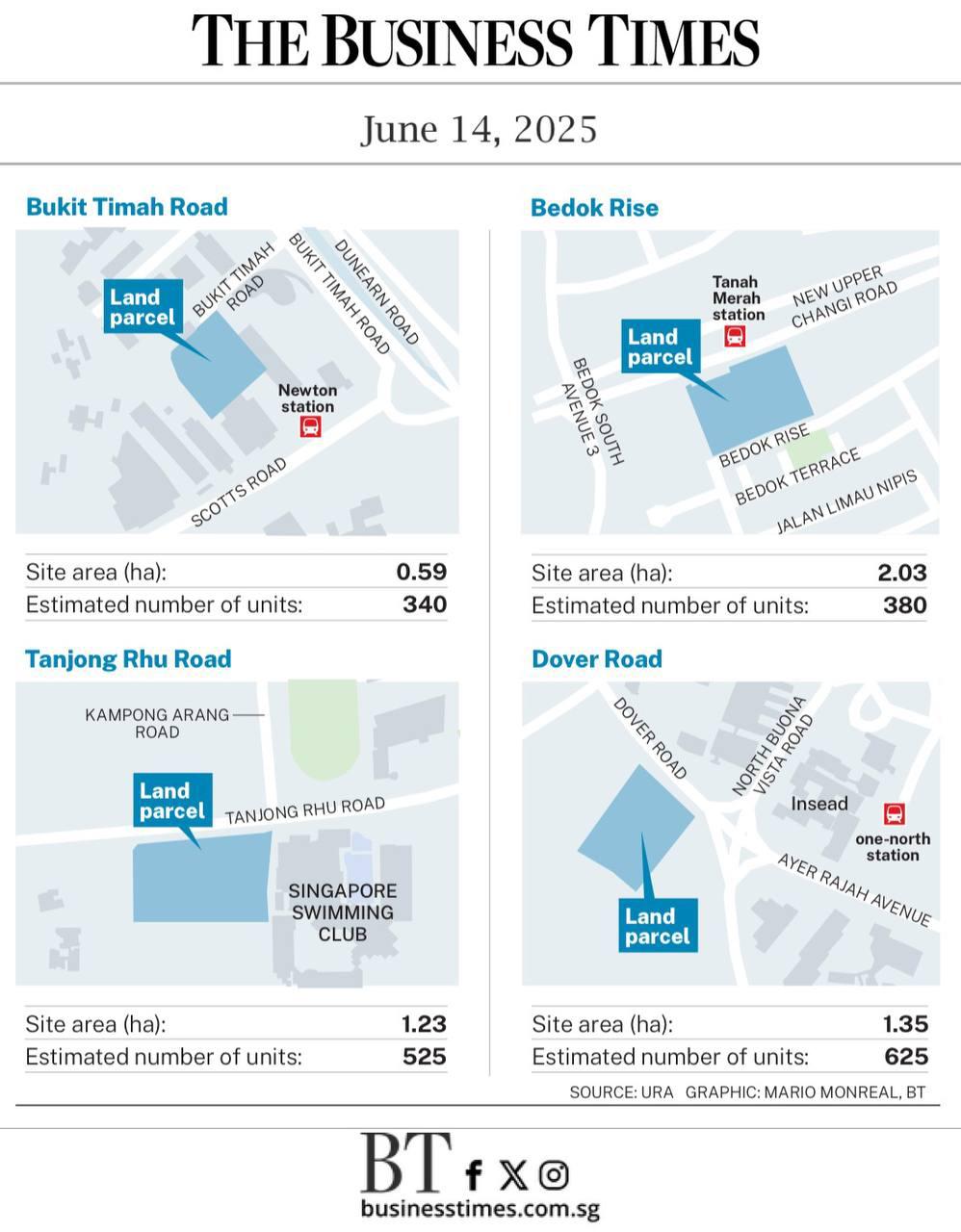

One of the most anticipated is a residential GLS site along Bukit Timah Road near Newton. The site is about 0.59ha and can yield about 340 units with a large gross floor area. It’s near the Newton MRT station and the central business district, making it a highly sought after location in a locale amid healthy demand. Market watchers say this is the first residential GLS site in Newton since Draycott 8 in July 1997 so it’s a rare opportunity for buyers who want private housing near the city fringe. The site’s launch date is expected to be announced soon, drawing significant attention from both developers and investors.

As the first residential GLS plot in Newton in nearly 30 years, it’s a historical moment. The nearby The Myst Condo is the type of luxury development that appeals to discerning buyers who want to be in this area. Given its rarity, this is likely the last residential GLS site and last development site in Newton for the foreseeable future.

Another big site is the Tanjong Rhu plot which is 1.23ha and can yield about 525 units. With a large gross floor area, this site has a lot of scope for a luxury residential project. Near the Katong Park MRT station and close to the Singapore Swimming Club, this site offers waterfront living and urban convenience. Market experts like Marcus Chu, CEO of ERA Singapore, expects strong bidding interest given the site’s location and lifestyle appeal. The Tanjong Rhu Dover area is still a hot spot for buyers who want premium private residential projects within the city fringe, further highlighting the area is in demand. For more on Singapore’s government land sales programme, visit the Urban Redevelopment Authority (URA) official site. This information is essential for those tracking Singapore housing sites 2025, as the GLS programme plays a pivotal role in shaping the availability and development of housing sites throughout the year.

Singapore housing sites 2025

Singapore housing sites 2025 continue to be a major focus for developers and investors, with the government land sales programme ensuring a steady supply of prime residential plots. Understanding the details of the GLS programme helps stakeholders anticipate upcoming opportunities and market trends related to Singapore housing sites 2025.

As the market evolves, keeping informed about Singapore housing sites 2025 will be critical for making strategic decisions in property investment and development. The URA site provides comprehensive resources and updates that reflect the latest on new housing sites unveiled and their impact on the market.

The Dover site near one-north MRT station is 1.35ha and can yield about 625 units. The Dover site addresses along Dover Road are known for their proximity to key employment hubs like one-north and Singapore Science Park so this GLS site is highly sought after by developers and homebuyers. Dover is a tech-centric community with proximity to INSEAD and is attractive to professionals and families who want a modern living environment with good amenities. Research and data analytics on market trends and demand patterns support the site’s appeal and its strong potential for sustained interest given its proximity to research and business hubs like Singapore Science Park.

In the east, the Bedok Rise plot is 2.03ha and can yield about 380 units. Near Tanah Merah MRT station and local amenities, it’s a prime choice for families and young professionals who want accessibility and a balanced lifestyle. Bedok and Rhu Dover areas are increasingly popular for private housing, reflecting growing interest in residential sites that offer convenience and community. Nearby developments like Parktown Residence is a testament to the area’s appeal.

Strong Executive Condominium Market

Along with these private residential sites, the government has released two EC parcels, signifying continued support for the EC market. The sale of two EC parcels is significant as it shows the government’s commitment to increasing EC supply to meet strong demand. These EC sites will add about 1,970 units to the annual EC supply – the highest since 2014 and each EC site has a big development potential for developers. Besides these, there are other EC site options across Singapore which adds to the overall EC supply in various locations. The three EC sites released this year puts the EC land availability in context and its impact on the market. Recent trends show that EC land prices have increased steadily, with record prices set at recent tender auctions. This rise in land prices directly influences the pricing of new EC projects and drives developer interest in upcoming sites.

The EC market is an important segment between public housing and private residential projects and EC projects are growing and popular among buyers. This segment offers an entry point for middle-income buyers who want private condominium-style living with more affordable pricing. The number of EC units sold in recent launches reflects the strong demand although some launched projects remain unsold, indicating a balance between supply and demand.

SRX and PropNex analysts say the sale of these two EC parcels will help to ease housing pressure and cater to the demand for upscale but affordable housing. The hybrid nature of EC units, combining private housing look and feel with government-backed affordability, continues to appeal to Singapore’s growing middle class. Recent EC land sales, including the record sale in Tampines, especially at the Tampines site, shows strong demand and competition in this segment. For more on Singapore’s government land sales programme, visit the Urban Redevelopment Authority (URA) official site.

Strong Response Expected

Market watchers expect strong demand and competitive bidding for the new sites, with many anticipating heightened interest from both developers and investors.

The release of these eleven sites, including the two EC parcels, will boost the residential market significantly. Among these, several are confirmed list sites which are officially up for sale and development, which means the government is committed to maintaining a steady supply pipeline. Leonard Tay from Knight Frank says the Newton site is exciting as it’s a rare prime land parcel in a sought after area. Wong Siew Ying from PropNex highlights the strong interest for the Tanjong Rhu plot due to its connectivity and amenities.

The GLS residential site released in this exercise will have an impact on market sentiment and give developers new opportunities to meet housing demand. Besides these confirmed sites, there are six residential sites on the reserve list which provide further options for future development. Of these, the remaining five residential sites are not triggered yet and their status will depend on market conditions and developer interest.

Market watchers also expect keen competition for the EC sites as there is a broader preference for affordable luxury living. Prime locations, attractive pricing and proximity to CBD and one-north will drive demand. These add to the overall private home supply which is crucial in addressing Singapore’s housing shortage relative to population growth.

Outlook and Market Implications

Despite the recent macroeconomic uncertainty, demand for residential units in strategic locations remains resilient. Tricia Song from CBRE says developers are showing cautious optimism, balancing enthusiasm with market analysis. Several reserve sites including River Valley Green, Marina Gardens Lane and Holland Plain are potential future development sites depending on market conditions.The release of these new sites is also important for long term urban planning as it supports Singapore’s vision of sustainable and connected communities.

The new residential GLS plots show the development potential and investment value of these sites. The second private residential site and the last GLS residential site in certain areas are rare and strategic for developers and buyers. The proximity to MRT stations like Newton MRT, Katong Park MRT and Sixth Avenue MRT stations make them more attractive. Other notable sites in the pipeline include Dairy Farm Walk, Lentor Central site, Dunearn Road site and Turf City housing estate, each with its own development prospects.

The cross street plot announced next to Telok Ayer MRT station offers new opportunities for long stay serviced apartments in CBD and is attracting cautious interest from developers. This approach helps to maintain Singapore’s reputation as a liveable city in South East Asia.

For Buyers and Investors

For buyers and investors, these new sites offer great opportunities. The combination of prime locations near transport nodes, good schools and lifestyle amenities is strong. Investors can benefit from potential long term capital appreciation as these sites are scarce. The potential for mixed use development – including dedicated or transitional office space – adds value and flexibility for both developers and end-users.

The release of Dover and Bedok sites and Newton Tanjong Rhu plots gives more options for those who want to enter or expand in Singapore’s private residential and EC market. The site launch marks a significant milestone and the rarity and demand for these sites among buyers and investors. With competitive pricing expected with high developer interest, buyers can look forward to an attractive entry price in these upcoming launches, making them even more appealing and accessible.

Conclusion: Seize the Opportunities

The release of these eleven new sites, including two EC parcels, is an exciting chapter for Singapore’s housing market in 2025. As the government continues to release residential GLS sites, the market will be active and growing. Buyers and investors looking to take advantage of these opportunities will have a wide range of options across prime districts like Newton Tanjong Rhu Dover and Bedok.Contact us today to explore your next property with Dunamis Property.