Strategic Restraint: Decoding the Dairy Farm Walk GLS Results

The recent URA tender for the Dairy Farm Walk site provides a fascinating glimpse into developer sentiment. With a winning bid of $962 psf ppr, market watchers are asking whether this signals a broader cooling trend in District 23. As a Data Decoder, I look past the headline to find the structural advantage for buyers.

The Logic Behind Developer Restraint

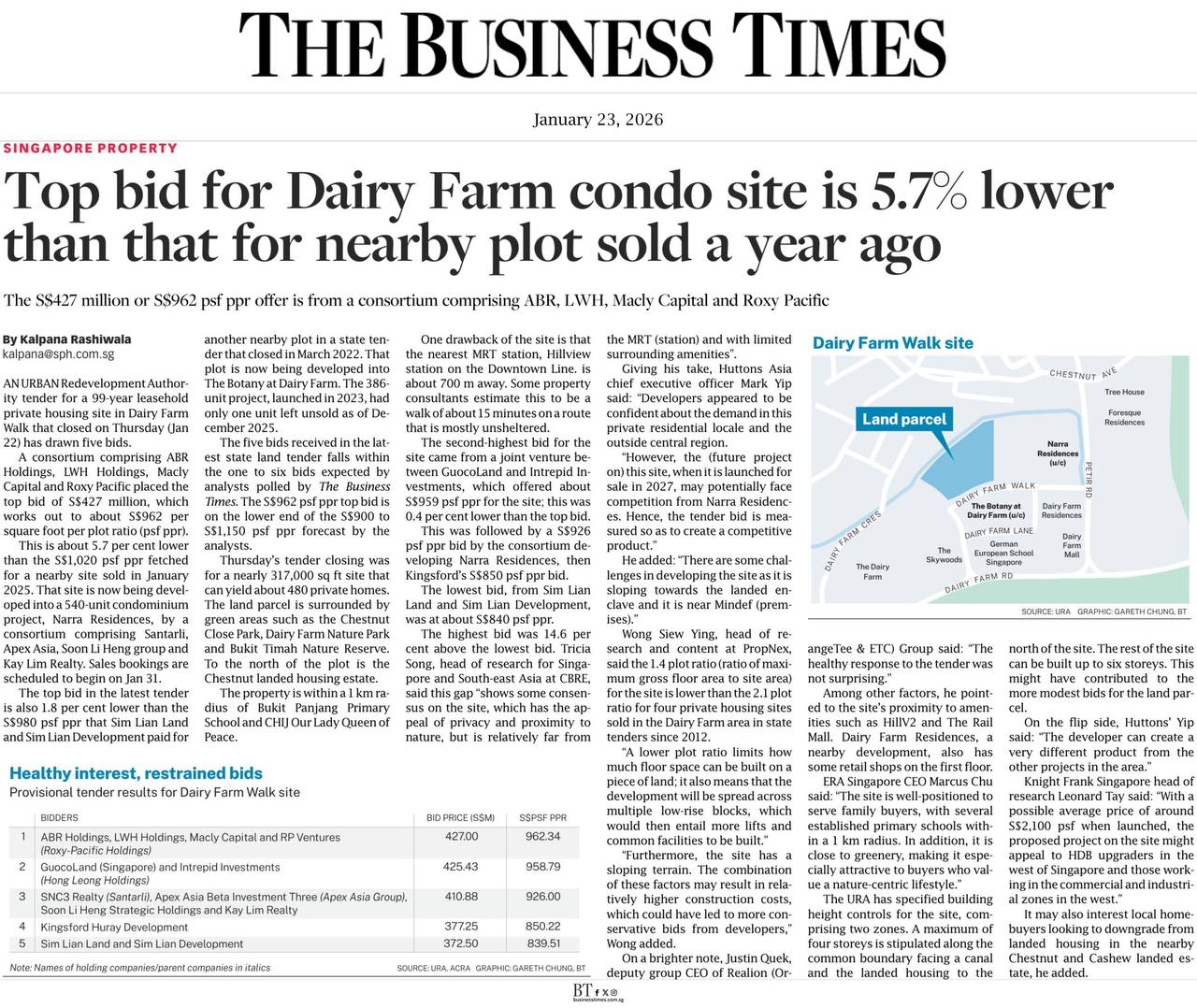

The $427 million top bid reflects a calculated approach to site-specific variables. Developers priced in topographical constraints, such as sloping terrain, and a lower plot ratio of 1.4, which restricts the project to a low-rise profile. Additionally, they factored in the current infrastructure maturity as the neighborhood continues to develop.

The Strategic Entry for Future Homeowners

This conservative bidding environment creates a distinct first-mover advantage. A lower land cost positions the developer to launch at a highly competitive estimated price of $2,100 to $2,300 psf. This sets up buyers with a high-upside, low-risk entry point into a growing enclave.

Furthermore, the 1.4 plot ratio mandates a 4-to-6 storey boutique architecture. This translates to an exclusive, low-density permanent ownership experience directly adjacent to the Chestnut and Bukit Timah Nature Reserves—an increasingly rare asset in land-scarce Singapore.

The Dunamis Verdict

The Dairy Farm Walk bid reflects healthy market discipline. For investors prioritizing layout efficiency, tranquility, and long-term value retention over immediate MRT proximity, this upcoming project is a compelling addition to the portfolio.

Frequently Asked Questions

What is the estimated launch price for the new Dairy Farm Walk condo?

Based on the $962 psf ppr land bid, market data indicates an estimated launch price between $2,100 and $2,300 psf, offering a highly competitive entry point for District 23.

Why did developers bid 5.7% lower for this specific site?

The lower bid reflects pragmatic site calculations, specifically the sloping terrain and a 1.4 plot ratio which limits the development to a low-rise, boutique profile rather than a lack of buyer demand.

Is District 23 a safe area for long-term property investment?

For buyers taking a 5-to-10-year horizon, District 23 offers strong structural value. The ongoing development of infrastructure and proximity to nature reserves creates a resilient asset class for both living and wealth preservation.