The 2026 Property Pivot: Why "Smart Money" is Prioritizing Moats Over Price

The launch weekend of January 31 – February 1, 2026, has provided the Singapore real estate market with a definitive case study in asset selection.

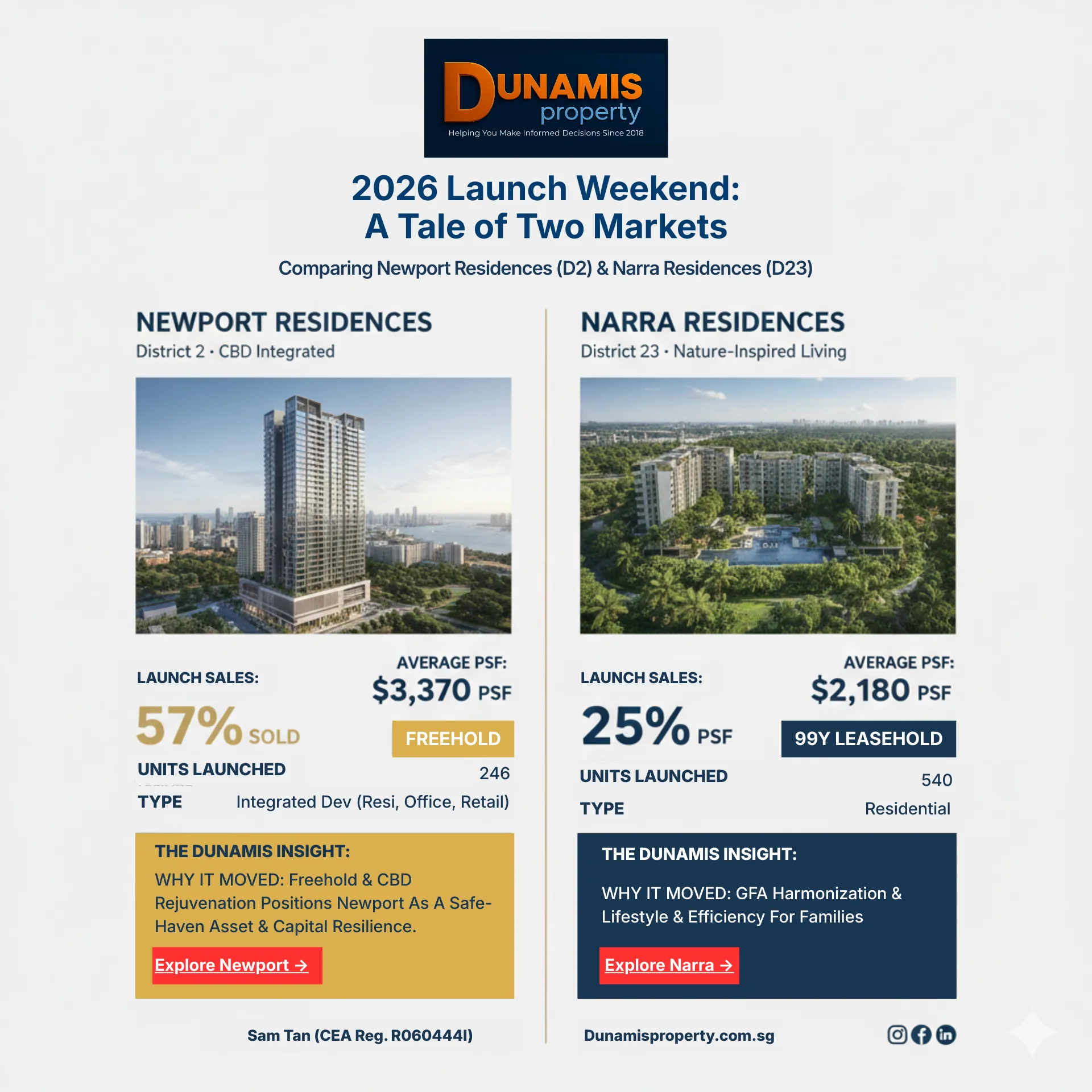

At Dunamis Property, we've observed a clear "Flight to Quality." While the market remains healthy, the way buyers are allocating capital has shifted from broad speculation to strategic "moat-building." Two projects defined this weekend: Newport Residences in the CCR and Narra Residences in the OCR. By looking past the headline PSF, we find a story of scarcity, efficiency, and long-term capital resilience.

A Tale of Two Markets: Newport vs. Narra Residences

The performance of these two launches highlights a bifurcation in the market. One serves the investor seeking a global "Safe Haven," while the other serves the modern family prioritizing layout efficiency.

Newport Residences: The Power of the CBD "Moat"

Newport Residences achieved a dominant 57% take-up rate at an average of $3,370 psf. To the uninitiated, the price tag seems steep. To the strategist, it is a calculated entry into a vanishing asset class.

- Tenure Scarcity: Newport is a rare Freehold integrated development. In a District 2 market increasingly dominated by 99-year leasehold Government Land Sales (GLS), permanent ownership acts as a hedge against inflation.

- The GSW Wealth Effect: Positioned at the gateway of the Greater Southern Waterfront (GSW), Newport is front-running a massive urban rejuvenation. Investors are betting on the "Live-Work-Play" transformation that will turn Tanjong Pagar into a 24-hour global wealth hub.

Narra Residences: The New Standard for Lifestyle Efficiency

In District 23, Narra Residences set a benchmark for the Dairy Farm precinct at $2,180 psf, moving 25% of its units. While the pace was more measured, the buyer profile was high-intent and value-driven.

- Decoding GFA Harmonisation: Narra is a pioneer of the 2026 GFA Harmonisation framework. Under these new rules, non-usable spaces like AC ledges are excluded from the saleable area. This means every square foot you pay for is usable internal space—making Narra one of the most efficient smart floor plan audits in the OCR.

- The Nature Reserve "Green Premium": Nestled next to 2,000 hectares of nature reserves, Narra offers air quality and tranquility that cannot be replicated. With the German European School (GESS) nearby, the rental demand from the expat community remains a strong long-term anchor.

Strategic Analysis: CCR vs. OCR in 2026

The gap between the Core Central Region (CCR) and the Outside Central Region (OCR) is narrowing. This "PSF Convergence" means that buyers must be more selective than ever.

| Feature | Newport Residences (D2) | Narra Residences (D23) |

|---|---|---|

| Primary Moat | Permanent Ownership & CBD Integration | GFA Efficiency & Nature Proximity |

| Risk Hedge | "Inflation-proof" "Safe Haven" | Lifestyle-led owner-occupier demand |

| Investor Profile | High-Net-Worth / Institutional | Young Families / Upgraders |

The Dunamis Philosophy: Structuring for Value

While no investment is without risk, the market often rewards assets with structural advantages. At Dunamis Property, we don't look for the "cheapest" unit; we look for the one with the strongest "moat." Whether it's the capital resilience of a freehold CBD asset or the high-upside, low-risk nature of a suburban retreat, success in 2026 is about positioning yourself where the supply is lowest and the demand is most consistent.

Frequently Asked Questions

Why did Newport Residences sell better than Narra Residences despite being more expensive?

Newport Residences outperformed Narra because it offers permanent ownership in a Central Business District where land is scarce. High-net-worth investors prioritized the long-term "Safe Haven" status of freehold property over the lower entry price of leasehold suburban projects during the 2026 launch weekend.

What is GFA Harmonisation and how does it affect property prices in 2026?

GFA Harmonisation is a URA framework where non-usable spaces like air-con ledges are no longer part of the saleable area. This makes newer 2026 launches like Narra Residences more space-efficient, meaning that while the PSF may appear higher, the buyer is getting more "liveable" square footage for their money.

Discuss This Analysis

Book a non-obligatory 1-on-1 session with Sam & Lisa to explore how this insight applies to your portfolio.