313@somerset May take hit

Lendlease Global Commercial REIT (LReit) has revealed that 313@Somerset may face rental pressure as the retail sector continues its cautious recovery. With tenant demand still soft amid post-pandemic uncertainties, the iconic Orchard Road mall is expected to see challenges during lease renewals and new tenant negotiations- Singapore Business Times

“Renting exercises are relied upon to stay delicate because of frail interest against Covid-19 headwinds,” it said in a business update for LReit’s first monetary quarter finished Sept 30.

“Retail occupants are embracing a cautious methodology and are recalibrating their cost structures, which may represent a test during lease restoration,” the director added.

Related Topic: New home sales surge to 11-month high in August

Inhabitance at the Singapore shopping center added up to 95.6 percent before the finish of September, despite the fact that its chief has made sure about another inhabitant from that point forward, which will improve the inhabitance to 98 percent.

Its occupant deals recuperated to about $42.6 million for July to September this year, more than triple that of $11.7 million for the past quarter and around 70% of pre-Covid-19 levels.

313@Somerset Sees Footfall Rebound Despite Headwinds

Visitation likewise improved quarter on quarter, adding up to 6.2 million individuals for the most recent quarter, practically triple that of 2.2 million for April to June and around 60% of pre-Covid-19 levels.

The administrator said on Tuesday that homegrown interest will continue driving tenant sales and visitor numbers at the shopping center, as travel restrictions remain in place.

Related Topic: Treasure At Tampines

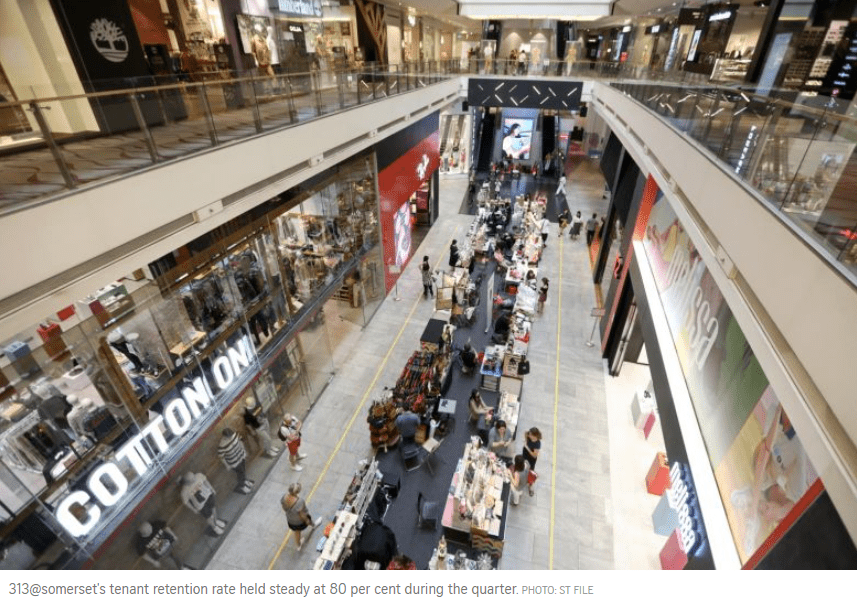

313 @ somerset’s inhabitant retention rate held consistent at 80% during the quarter.

Sky Complex in Milan, which contains three Grade-A office buildings, remains fully leased until 2031, except for the tenant’s break option in 2026.

The occupant, satellite TV stage Sky Italia, has made all its rental installments in an ideal way with no rental waiver in truth, LReit’s supervisor said. This came as Sky Italia continued to work its telecom business during the pandemic, with safe administration gauges set up.

The steady income from Sky Complex helps LReit secure its earnings as the coronavirus pandemic continues to impact the retail sector.

LReit maintained full occupancy across its portfolio properties, although the occupancy rate dipped slightly to 99 percent as of Sept 30, down from 99.5 percent in June.

Related Topic: 6 Facts About The Singapore Real Estate Market

Leases that are terminating by June 2021 make up around 3 percent of the net lettable territory (NLA) and 12 percent of gross rental pay (GRI).

In this way, the weighted normal lease expiry of LReit’s portfolio added up to 9.5 years by NLA and 4.9 years by GRI as of end-September.

it’s outfitting proportion was 35.6 percent as of Sept 30, up somewhat from 35.1 percent as of June 30.

Overseas Assets Help Stabilize LReit’s Income

On Oct 1, LReit purchased a stake in the Jem rural shopping center in Singapore through a 5 percent premium in Lendlease Asian Retail Investment Fund 3, for about $45 million. The asset, overseen by an auxiliary of LReit’s sponsor Lendlease Corp, in a roundabout way holds a 75 percent interest in Jem.

Download Penrose Brochure to clear your dream home.

LReit’s chief said the acquisition boosts revenue diversification, as Singapore’s Ministry of National Development has fully leased the workplace component—about 35 percent of the property’s NLA—on a long-term basis.

Lalit units rose 0.5 pence or 0.8 percent to 62 pennies as of 11 am on Tuesday.

Upcoming Ki Residences Condo Launch will be another remarkable project at Clementi.